Do ETFs Pump Up Emerging Markets?

Kurt Brouwer November 12th, 2009

Jason Zweig asks a very good question in a Wall Street Journal column:

ETFs Causing Bubble in Emerging Markets? (Wall Street Journal, November 10, 2020, Jason Zweig)

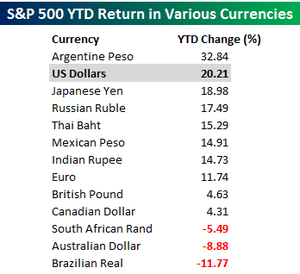

U.S. investors have pumped roughly $26 billion into emerging-markets funds so far this year. Of that, $15 billion came in through exchange-traded funds — portfolios that hold every stock in a market benchmark with utterly no regard to price.

…As money pours into the ETFs, they must mechanically match their holdings to those in the emerging-market indexes. That forced buying drives up stock prices, attracting still more new money into the ETFs, spiraling stock prices even higher.

…Consider Brazil. The iShares MSCI Brazil Index ETF has nearly tripled in size over the past 12 months. Now at $10.9 billion in assets, it has vacuumed up $2 billion in new money this year. Fully 38% of the fund is invested in only two firms: oil giant Petrobras and mining company Vale do Rio Doce.

Yikes. U.S. regulations limit ETFs from huge concentrations in a given emerging market stock, but that limitation is still a matter of perspective because 38% in two stocks seems pretty concentrated. Unfortunately, the nature of many emerging market economies is that there are only a few large, publicly-traded companies in which to invest. When a country specific ETF or mutual fund gets a flood of new cash, the only practical way to put that money to work quickly is to invest in large companies.

The Wall Street Journal continues:

…Thanks to obscure provisions of the U.S. Internal Revenue Code and the Investment Company Act of 1940, which governs how mutual funds are organized, ETFs can’t allow their assets to become over-concentrated in a handful of holdings. In general, they can’t keep more than 25% of their money in a single stock, and at least half of their assets must be in securities that each account for no more than 5% of total holdings.

Having 25% of an ETF’s entire portfolio in one stock can lead to problems at the fund level too. Let’s say investors tire of Brazil and want to pull out 25% of the ETF’s assets. The ETF (or mutual fund) has to sell shares in order to raise cash. Ideally, the ETF would sell shares across its portfolio, but problems can ensue.

With only two very large holdings that together add up to 40% or 50% of the fund, it’s not practical to raise the 25% cash needed just by selling Vale and Petrobras. The reason is that the fund’s selling of large amounts of stock would almost certainly put pressure on the share price of those companies, thus hurting the ETF’s net asset value and precipitating more sales of the ETF by rattled investors.

To avoid too much selling pressure on the two main holdings, the ETF might want to raise cash by selling smaller company shares. Unfortunately, the same problem occurs. Sales of even modest shares in thinly-traded small company stocks would probably lead to lower prices, leading to a lower NAV, which leads to more selling of ETF shares…You get the idea.

The Wall Street Journal continues:

…So what does all this mean for investors? ETFs probably haven’t caused a bubble, and they might even help a bit to prevent one from forming. But many will remain superconcentrated bets on very risky markets. If you invest in an ETF with most of its assets in a few stocks and think you have made a diversified bet, the real bubble is the one between your own ears.

The answer is that ETFs and mutual funds do not pump up emerging market stock markets all by themselves. But, they do exacerbate the market mood swings, both on the way up and the way down.

My takeaway from this piece and from my experiences with emerging markets over the past 30 years is that the long-term returns from an investment in emerging markets should be higher than returns from investments in developed economies. Therefore, it may make sense for a diversified investor to have a stake in these rapidly-growing economies.

Like shark’s teeth…

However, the boom and bust cycles in emerging economies are far more pronounced too, so you have to patient. Like shark’s teeth, getting in is easy, but getting out unscathed can be more difficult…and more painful.

- Business , ETF , Energy , Geopolitics , Investing

- Comments (1)