Kurt Brouwer May 29th, 2009

We have not heard much about the bond market vigilantes since the early years of the Clinton presidency. But now, they’re back!

Carville, Clinton and the Vigilantes

If you don’t remember those days of yesteryear, I can give you a short summary. Back in 1993, President Clinton’s first year in office, interest rates on bonds began rising due to fears of incipient inflation. Those fears stemmed from the inflationary spending plans such as nationalized healthcare and other government programs that threatened to increase Federal budget deficits.

One of President Clinton’s advisors, James Carville, famously quipped that in his next existence he wanted to come back as the bond market because it could intimidate everyone. What Carville and President Clinton grasped back then is that there is a limit to the level of deficit spending that can be absorbed without triggering higher inflation.

Unfortunately, that lesson may have to be relearned as this Bloomberg piece indicates [emphasis added]:

Bond Market Vigilantes Confront Obama as Housing Falters (Bloomberg, May 29, 2020, Liz Capo McCormick and Daniel Kruger)

For the first time since another Democrat occupied the White House, investors from Beijing to Zurich are challenging a president’s attempts to revive the economy with record deficit spending. Fifteen years after forcing Bill Clinton to abandon his own stimulus plans, the so-called bond vigilantes are punishing Barack Obama for quadrupling the budget shortfall to $1.85 trillion. By driving up yields on U.S. debt, they are also threatening to derail Federal Reserve Chairman Ben S. Bernanke’s efforts to cut borrowing costs for businesses and consumers.

The 1.5-percentage-point rise in 10-year Treasury yields this year pushed interest rates on 30-year fixed mortgages to above 5 percent for the first time since before Bernanke announced on March 18 that the central bank would start printing money to buy financial assets. Treasuries have lost 5.1 percent in their worst annual start since Merrill Lynch & Co. began its Treasury Master Index in 1977.

“The bond-market vigilantes are up in arms over the outlook for the federal deficit,” said Edward Yardeni, who coined the term in 1984 to describe investors who protest monetary or fiscal policies they consider inflationary by selling bonds. He now heads Yardeni Research Inc. in Great Neck, New York. “Ten trillion dollars over the next 10 years is just an indication that Washington is really out of control and that there is no fiscal discipline whatsoever.”

…Bill Gross, the co-chief investment officer of Newport Beach, California-based Pacific Investment Management Co. and manager of the world’s largest bond fund, said all the cash flooding into the economy means inflation may accelerate to 3 percent to 4 percent in three years. The Fed’s preferred range is 1.7 percent to 2 percent.

“There’s becoming an embedded inflationary premium in the bond market that wasn’t there six months ago,” Gross said yesterday in an interview at a conference in Chicago.

…This time it’s different because the Congressional Budget Office projects Obama’s spending plan will expand the deficit this year to about four times the previous record, and cause a $1.38 trillion shortfall in fiscal 2010. The U.S. will need to raise $3.25 trillion this year to finance its objectives, up from less than $1 trillion in 2008, according to Goldman Sachs Group Inc., one of 16 primary dealers of U.S. government securities that are obligated to bid at Treasury auctions.

This times it’s different and how. As fears of the financial panic recede, investors around the world are re-assessing U.S. Treasury securities and finding that the trend is not favorable. That has begun to hurt the dollar and our creditworthiness as a nation. Bloomberg continues:

…The dollar has also begun to weaken against the majority of the world’s most actively traded currencies on concern about the value of U.S. assets. The dollar touched $1.4135 per euro today, the weakest level this year.

…Ten-year yields climbed from 5.2 percent in October 1993, about a year after Clinton was elected, to just over 8 percent in November 1994. Clinton then adopted policies to reduce the deficit, resulting in sustained economic growth that generated surpluses from his last four budgets and helped push the 10-year yield down to about 4 percent by November 1998.

…The bond vigilantes are being led by international investors, who own about 51 percent of the $6.36 trillion in marketable Treasuries outstanding, up from 35 percent in 2000, according to data compiled by the Treasury.

…Chinese Premier Wen Jiabao said in March that China was “worried” about its $767.9 billion investment and was looking for government assurances that the value of its holdings would be protected.

… “We have daily reminders from bond vigilantes like Bill Gross about the prospect of losing our AAA rating,” Federal Reserve Bank of Dallas President Richard Fisher said in Washington yesterday. “This cannot be allowed to happen.” …

Losing our AAA status would be both disruptive and inflationary. I really don’t know what the odds of that happening are, but I agree with Dallas Fed President Fisher that it must not be allowed to happen (for more on Fisher’s thoughts on foreign holders of our bonds and on inflation, see China: Not So Quiet on the Eastern Front).

Given that government deficits are growing, government debt and financing needs will also grow:

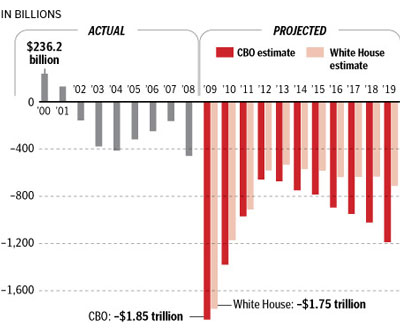

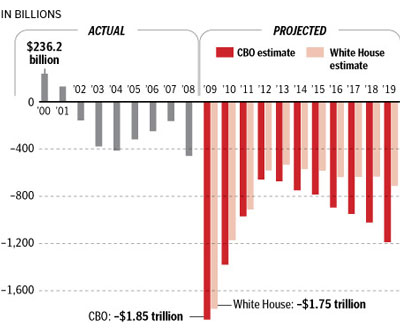

The following chart is one we posted a while back and it has also been included on many other blogs. The point it makes is startling and subsequent events have shown that the CBO estimates used in the chart are now the consensus even at the White House.

The government is incurring debt and ‘printing’ new money at a faster rate than we have seen since World War II. One likely result of this will be budget deficits and pressure for higher taxes - income taxes, corporate taxes, gas taxes and sales taxes. Assuming we have higher tax rates, this will have a negative impact, as it always has, on future economic growth.

This chart from the Washington Post illustrates what we have in store when it comes to Federal budget deficits. The right side of the following chart compares the CBO’s projection for future budget deficits with the White House projections. The left side shows the deficits for previous years, many of which seemed very high at the time. Now, they seem pretty modest by comparison.

Source: Washington Post

Government’s financing needs are growing — actually soaring — so interest rates on Treasury bonds are likely to go up over time simply because the Treasury is trying to issue so many bonds. It’s that archaic and outdated supply and demand thing that musty economics books discuss.

From this report on the U.S. Treasury web site, dated April 29, 2020, we find a clear and concise description of what is to come [emphasis added]:

…Yields on the 30-year bond have risen as of late and are probing their highest level since Autumn 2008. With inflationary pressures scant, the rise in long-dated rates largely is a by-product of the Treasury’s outsized funding needs in the period ahead.

Those outsized funding needs reflect the lackluster outlook for economic growth and the expansionary budgets being pursued by Congress and the Administration. Tax receipts are collapsing amid economic malaise. Revenue is down by nearly 14% in the first half of FY09 and April receipts are tracking their weakest level in years. At the same time, public expenditures continue to surge as automatic stabilizers (unemployment compensation, food stamps, etc.) kick in and the government plows resources toward stabilizing financial firms and domestic demand. In sum, fiscal outlays have increased by over 30% on a year over year basis.

Treasury’s net borrowing needs likely will total about $2 trillion this year, a staggering one-seventh of GDP. Given the outlook for the economy, the cost of restoring a smoothly functioning financial system, and the pending entitlement obligations to retiring baby boomers, the fiscal outlook is one of rapidly increasing debt in the years ahead. Given the outlook for the economy, the cost of restoring a smoothly functioning financial system, and the pending entitlement obligations to retiring baby boomers, the fiscal outlook is one of rapidly increasing debt in the years ahead. While unlikely to materially affect real long-term interest rates today, such a fiscal path could force real rates notably higher at some point in the future…

In other words, the current deflationary trend is still holding Treasury interest rates back, but a few years from now, watch out. Also, the report used the term ‘real rates’ which refers to inflation-adjusted rates. The likelihood is that inflation will be making a comeback in the next few years as well.

As investors, we have to deal with the present disinflationary trend, but also be ready to pivot when inflationary trends begin to take hold. The current rise in prices for oil, gold and other commodities may be a harbinger of inflation immediately ahead or these price increases may just be a reaction to the extremely low prices of late last year.

Right now, I believe intermediate term bond funds are extremely attractive with good yields and even some capital gains potential. Bill Gross’s Pimco Total Return (PTTRX) is an example. I’m not a big fan of Treasury bonds now because yields are going up. As Treasury yields go up, the spread between them and corporate bond yields or mortgage-backed bond yields will narrow.

The Balance Between Disinflation and Inflation

I believe portfolios will have to evolve over the course of the next year or two to be responsive to this new environment. Bonds, especially those with longer maturities, have done poorly in past inflations. Treasury Inflation Protected Securities are one solution. Intermediate term bond funds are another solution as are short term bond funds. Equities have historically been decent, although imperfect, inflation hedges. Other opportunities that should benefit from rising inflation would be energy and commodity-related investments.

Inflation is coming in my opinion and it could go above the levels we had gotten used to over the past 10 years or so. However, I still believe we are in the deflationary or disinflationary phase of this cycle and that inflation is going to remain moderate for a while

The wild card in my thinking is the Federal government. If the Federal government (state governments too) continue on this wild spending and borrowing spree, inflation expectations will change.

Soaring budget deficits brought out the bond market vigilantes 15 years ago. If this trend continues, we will see their rough brand of justice again.

Full Disclosure: Kurt Brouwer owns shares in Pimco Total Return Bond Fund (pttrx)