Kurt Brouwer November 2nd, 2009

What happens when we enter high inflation?

My experience with inflation dates back to the 1970s and early 1980s. Inflation averaged almost 8% for the entire decade of the ’70s, but it cranked up into double digits in 1979. Let’s head back to those days of yesteryear — the early 1980s — and compare some key indicators to the situation back then.

Here is a good chart showing key interest rates plus inflation and unemployment, then and now:

Source: Carpe Diem

I suspect you could win some bets with some of these statistics. How many folks remember that home mortgage rates hit 18% back then? Or, another statistic that is not shown in the chart is that home mortgages rates averaged 12% from 1979 through 1985?

Is inflation an immediate problem?

Inflation is not a huge problem now as it was throughout the 1970s and early 1980s. For example, inflation is now running in the Fed’s sweet spot of 1-2%. However, given all the monetary stimulus and government spending we have seen, inflation is definitely a threat, but one that has not really manifested itself yet. I do not expect us to get back to the inflationary climate we saw in the 1970s, but none of us knows what lies ahead.

If you believe inflation is on the way, you also need to figure out where in the inflationary process we are. If, like the early 1970s, you think inflation is underway and the Federal Reserve will not attack it for quite a while, then inflation hedges make some sense. However, if you think the Fed might be planning to raise interest rates soon in order to counteract inflation, then inflation hedges could be a problem. Here’s why.

If inflation went quite a bit higher, the Fed would eventually be forced to raise short-term interest rates. Long-term interest rates would certainly go up and that would be bad for those holding long-term bonds. Once interest rates begin moving up, then economic activity would probably slow down, bringing us into recession and that would hurt most other assets such as real estate and stocks.

For example, in 1979, the Federal Reserve (under Chairman Paul Volcker) decided to really attack inflation by raising the Fed Funds rate (short-term interest rates). As you saw in the chart above, interest rates on home mortgages went way up. As rates went up, economic activity fell off and we entered a recession. In that environment, most assets fell (real estate, stocks, bonds). Gold prices lagged the decline in other assets, but they also fell.

Gold in 1980 — from darling to dog in two years

In fact, gold hit a high point in 1980 of $875 per ounce, but it fell as low as $463 within a few months. Gold prices went back up into the $700 range, but by 1982, gold prices had fallen to a low of $298 per ounce. That’s right. From a high of $875, the price of gold fell to around $300 within a couple of years. Beginning in 1982, inflation fell quickly from the double digit level, but gold prices fell much more quickly as gold had a 60% price decline.

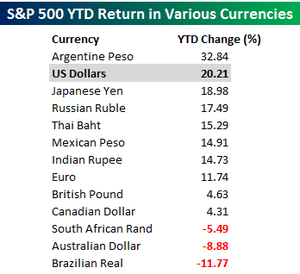

Now, gold is hitting new prices highs due, in my opinion, largely to the weakness of the U.S. dollar. There are other factors at work in the price of gold, but for U.S. investors the dominant issue at work is the falling dollar. The point here is that you need to make sure you are buying gold — or any other asset — for good, solid, long-term reasons. A little further on I’ll give you my thoughts on the best way to buy gold.

What should I do about inflation?

If you believe high inflation is coming our way, how do you protect your portfolio? This piece from the Wall Street Journal covers some solutions and we add a few more ways to protect your portfolio from the ravages of high inflation.

However, be careful out there, because it is not as easy or straightforward as some would have you think. The key takeaway I have for you is that you should seek investments that you believe are undervalued and likely to go up in value. That’s how you keep your portfolio growing:

Inflation-Protection Strategies Offer Investors No Guarantees (Wall Street Journal, October 5, 2020, Jeff D. Opdyke)

Worried investors have been looking for insurance in the form of assets such as mutual funds and exchange-traded funds focused on gold, commodities and Treasury inflation-protected securities, or TIPS. In the past year, interest in TIPS funds in particular has been running at record levels, with some weeks recording more than $400 million in sales.

But many of these investments have never been tested during a bout of meaningful inflation. The last time inflation ramped up significantly was three decades ago. Yet TIPS have been around only since the late 1990s, and commodity funds are of even more recent vintage, as are the gold funds that invest in bullion or track the metal’s market price.

This is a really important point. Wall Street is great at coming up with new and complex investment opportunities. However, the track record on Wall Street innovations is not good.

Be cautious with new or untested investments

I think of it just like new operating systems for a computer. I never rush to upgrade my computer with the latest, groovy operating system because I know there will be bugs. I wait a few years usually before upgrading so that the bugs will largely be fixed before I make the switch.

I view innovations from Wall Street with even more skepticism than I do new operating systems for my computer. In general, if it is new — and complex — and it’s from Wall Street, I pass.

As an example, consider commodity-oriented exchange-traded funds (ETFs). They are new and relatively untested, so be cautious. One critical issue with commodity mutual funds or ETFs is whether or not they actually hold commodities or just a basket of futures contracts for a given commodity. With precious metals, it is possible to actually hold a commodity such as gold. However, some commodities such as agricultural products or even oil or gas are less likely to be owned directly by a given fund. In many cases then, an ETF or mutual fund just holds future contracts or notes redeemable by a bank.

There are some mutual funds such as Pimco Commodity Real Return Fund (PCRDX) that seek to benefit from investments in commodity-related securities. Here’s how Pimco describes the investment strategy:

PIMCO manages CommodityRealReturn Strategy by combining a position in commodity-linked derivative instruments backed primarily by a portfolio of inflation-indexed securities…Other fixed income instruments may also be used tactically in the portfolio. The commodity-linked derivatives capture the price return of the commodity futures market, while our active management of the fixed income assets seeks to add incremental return above those markets, along with additional inflation hedging…

This type of fund can give you exposure to commodity-related investments, but it is no walk in the park. We use this fund a bit, but we do so knowing it can be very volatile. For example, in 2008, it fell over 43%.

Tracking error

Commodity mutual funds or ETFs have the potential to go up in value due to inflation, but they are inherently volatile. And, as we saw above, they often also invest in futures contracts and other so-called derivatives that can lead to unintended consequences as shown by this piece from MarketWatch. It illustrates the point with examples of commodity or precious metals ETFs that had results wildly divergent from the actual commodity or metal they are tracking:

…The United States Natural Gas Fund (UNG) , for example, has tumbled 50% this year while natural gas prices are down about 12%…

Natural gas prices go down so you expect the fund to go down, but a loss of 50%? Ouch.

…PowerShares DB Oil Fund’s flexible strategy helps it navigate market conditions…Since the fund’s inception in early 2007, it has gained about 16% while oil prices have risen about 40%…

Nothing wrong with a gain of 16% since 2007, but that return significantly lags the actual increase in oil prices. As long as you understand what a commodity or precious metal mutual fund or ETF does, then that’s fine. I suspect many investors in UNG are a bit mystified though.

If you are interested in investing in precious metals, I would simply just own them directly. That is, buy some gold coins or silver coins and hold them in a safe deposit box. If you do go that route, you have the coins and there is no muss or fuss. As a second best choice, I would buy an ETF such as the SPDR Gold Trust (GLD), which, by its prospectus, actually buys and holds gold at its custodian in London.

Other ETFs or mutual funds investing in precious metals or commodities may simply be putting together a basket of futures contracts on the commodity in question. That’s fine if you have faith in the ETF or fund provider, but how exactly those contracts will perform in volatile markets is a bit of a question mark.

The Wall Street Journal continues:

…Though long heralded as a hedge against inflation, gold hasn’t always gone along for the ride when U.S. consumer prices are rising. Consider data from Morningstar Inc.’s Ibbotson Associates research and consulting unit: The correlation of spot gold prices to an Ibbotson-tracked inflation benchmark is just 0.096. (Correlation is perfect at 1; the closer to 0, the less the correlation.)

Certainly, gold has done well in some inflationary periods, like the late 1970s, when the metal spiked above $800 an ounce. Still, investors would do better to view gold as an international currency that hedges against weakening paper currencies, particularly the dollar. For instance, the U.S. dollar index, tracking the greenback’s performance against a basket of currencies, has slipped more than 13% since March, when the index hit its peak so far for this year. Gold prices, meanwhile, are up more about 14% so far this year.

…But there’s another issue: What does your gold fund own?

Exchange-traded funds such as SPDR Gold Shares and related trust products such as Canada’s Central GoldTrust own physical bullion, held in secure bank vaults and regularly audited.

Others don’t own physical gold and instead seek gold exposure through derivatives. PowerShares DB Gold, for instance, tracks an index of gold-futures contracts…

In mutual funds or ETFs that invest through futures contracts on gold or silver, there are a number of risks. The obvious one is that spot prices for a given precious metal and futures contracts for that metal have very different prices as we saw from the examples above. In a rising market, the fund would often underperform spot prices. That can be very disappointing if you bought a fund and the precious metal followed the trajectory you anticipated, yet the fund lagged far behind.

So, there is the issue of the internal structure and strategy of the fund or ETF. But, there are also other issues. The Wall Street Journal continues:

…Many commodity-based securities are exchange-traded notes, or ETNs, which pose a different risk. Unlike ETFs, which generally own a pool of hard assets or securities, ETNs own nothing. They are promissory notes issued by a bank, meaning they’re unsecured debt; the return you earn is calculated based on the movement of an underlying commodity index.

“You’re loaning money to a bank, and the bank pays you the return of the underlying index,” Morningstar’s Mr. Burns says…

Hmmm. Loaning money to a bank. What could go wrong?

Going beyond precious metals or commodity funds, here are some thoughts on different asset classes of funds and how they might fare during inflationary times:

Money market mutual funds: One very good investment in times of high inflation is cash in a money market funds. Assuming interest rates go up due to inflation, the return on the money market fund should go up too. In a money market fund, interest rates are variable, so your money will begin earning higher interest as soon as rates go up.

Short-term & intermediate-term bond funds: If you have some fixed income investments, as a first step for an inflation conscious investor, I would shorten the maturity of any bonds or bond funds you own and use short-term and intermediate-term bond funds primarily. You could also put some assets in a fund that invests in Treasury Inflation Protection securities as mentioned above.

U.S. stock mutual funds: Stocks can do quite well in a moderate inflationary environment, in particular stocks of companies that have pricing power. However, if inflation really takes off, eventually the Federal Reserve would have to raise interest rates and that would result in a recession in all likelihood. Recessions are not generally good for stocks.

International stock mutual funds: The points made above about U.S. stock funds apply generally to international stock funds too. In addition, there is the currency issues. That is, most international funds hold stocks in currencies other than the U.S. dollar. As such, if inflation has a negative impact on the dollar, then those funds should benefit. The flip side is true also though. That is, if the dollar strengthens, then most international funds would suffer a bit due to their non-dollar exposure. Right now, international stock funds are benefiting from higher share prices plus currency gains from the falling dollar.

Real estate mutual funds: Real estate has been struggling for a couple of years now. Residential real estate started falling first and now commercial real estate is taking a big hit. Assuming you are a long-term investor and assuming you are worried about inflation, real estate funds are worth a look. It may be premature at this point because real estate is still weak, but historically real estate has done pretty well during inflationary times. I would wait a bit on this though.

In closing, I’ll make a couple of points. First, there is no guarantee that we will go through a high inflationary period. There is pretty solid evidence that inflation will be moving up at some point, but that does not mean we will get back to the type of inflation we saw in the 1970s. Also, as you know, disinflation, not to mention, deflation, is still a possibility although probably a much lower one than inflation. But, if the economy fails to re-ignite, we could drift into another recession in a year or two and that would mean most inflation-centric investments might suffer.

When it comes to investing, I believe a diversified portfolio works best because the future is not knowable. That is, do not bet all your assets on one specific scenario such as high inflation. You can certainly do things to lessen the impact of inflation on your portfolio, but do not put all your assets in one narrow strategy.

Disclosure: Kurt Brouwer owns shares of Pimco Commodity RealReturn Fund (PCRDX)